The software also shines in usability with its clean, intuitive dashboard that allows for easy navigation and data access. Users highlight Clio’s flexibility to customize views, automation to reduce manual work, and ability to integrate with other tools through open API. A gradual, department-by-department implementation approach helps secure user buy-in and work out issues. Consider starting with a small pilot group to test the software, gather feedback, and address any concerns. Gradually expand the rollout to other departments in waves based on team readiness and priorities.

Get in Touch With a Financial Advisor

Conclusion In summary, fiduciary accounting software is not just a tool for compliance and record-keeping; it is a strategic asset that gives teams a competitive edge. By enhancing efficiency, ensuring accuracy, strengthening compliance, and improving client service, this software is indispensable for any team looking to excel in the field of fiduciary accounting. It’s an investment that pays dividends in terms of productivity, client satisfaction, and overall business success. When setting up a trust account in QuickBooks Online and Clio, make sure you’re using the right QuickBooks Online subscription. Be sure to go through the steps mentioned above for setting up a new trust account. To ensure you are managing your accounts in an ethical and compliant way, always check the rules for managing trust accounts in your jurisdiction.

Automated setup

SoftLedger’s venture capital accounting software is feature-rich to support all your consolidation needs. The ideal tool for tracking your crypto asset management transactions in a scalable way. Get a powerful crypto accounting software that automates all your cryptocurrency transactions. The rich analytics and customization options in Oracle NetSuite and Microsoft Dynamics 365 make them well-suited for complex organizations. With the right solutions in place, corporate accountants can optimize workflows, reduce risks, and support intelligent decision-making across the business.

Get started with LeanLaw

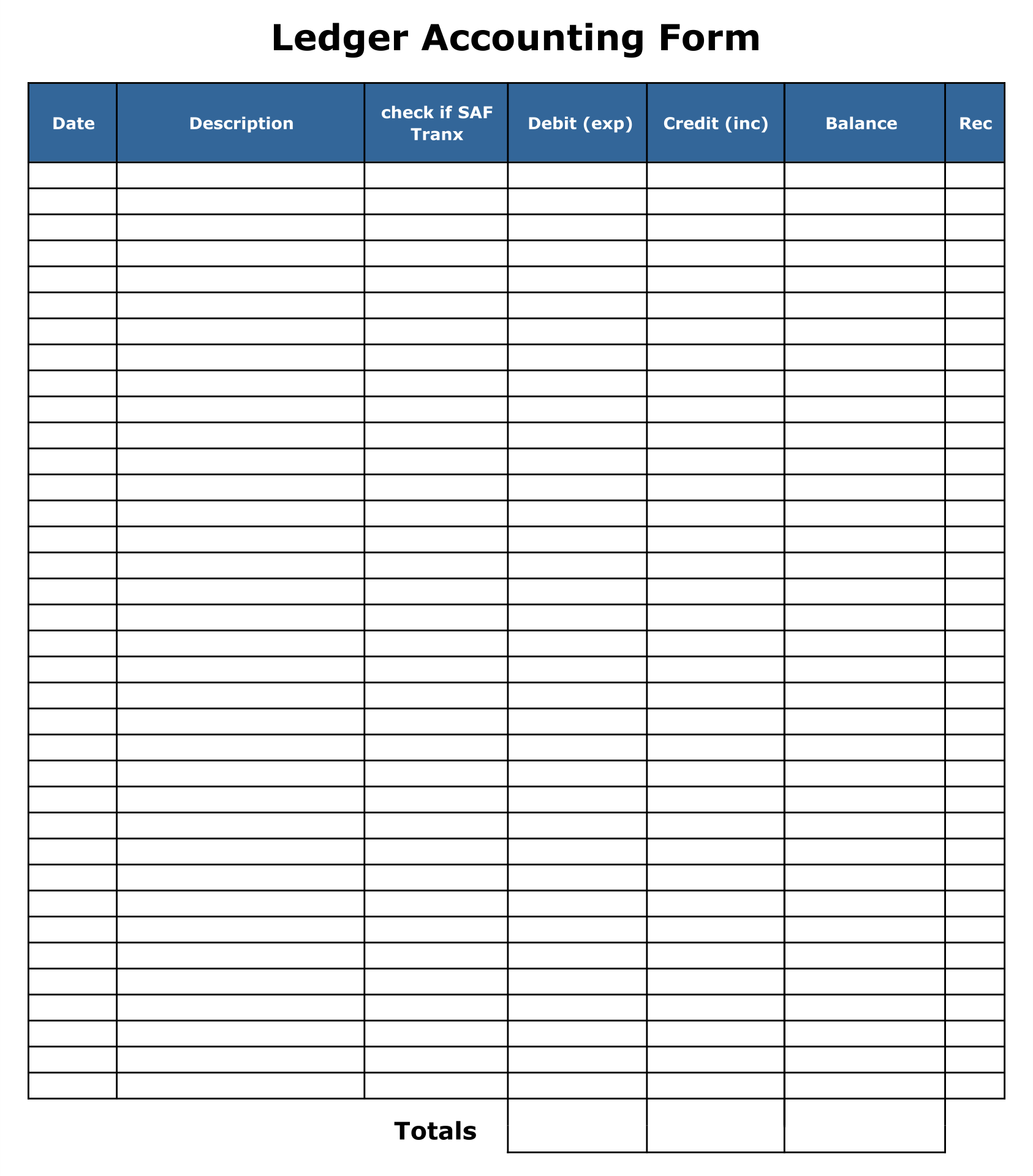

Do you need help recording your transactions or do you have any other concerns regarding your Chart of Accounts? This is just a general way of creating your accounts in QuickBooks Desktop. I would still recommend reaching out to an accountant well-versed in the Desktop version.

Three-way reconciliation

It also offers audit trails, auto-generated reports, client portals, and other accounting solutions your practice might need. TrustBooks is simple, easy-to-use accounting software for smaller legal firms. To solve these issues, we’ll introduce you to our own product, SoftLedger, as well as several other accounting software solutions for fiduciary accounting software quickbooks trusts you might want to consider. Trust accounting platforms should exceed security standards for financial data. Verify reporting features also include breach and risk detection alerts. With LeanLaw by your side, you can focus on what you do best – practicing law – while leaving the complexities of trust accounting to the experts.

These are the Best 5 Practices for Hiring Virtually

- Whether you’re looking to streamline IOLTA tracking or need robust conservatorship accounting tools, there are solutions available to fit your firm’s specific needs and compliance requirements.

- But now I will need the ability to create clients/cases and to input all transactions specific to that client and to produce acceptable fiduciary accountings for it.

- TrustBooks also has simple pre-set workflows designed to help non-accountants streamline their accounting processes.

- It is essential for maintaining transparency, accountability, and compliance with legal and regulatory requirements while safeguarding the interests of beneficiaries.

- Seamlessly track and integrate your inventory with SoftLedger’s retail accounting software.

How do I do the steps that Laura Dion outlined in her response in QuickBooks Desktop, please? Can you share the detailed steps of how to set up the Trust account info and record deposits, payment of expenses, payout to the firm, etc in QBDT. It was so complicated that I changed my Trust Account nad opened a checking Account to hold those funds so I could write checks back to the client and also to myself to pay invoices. HOWEVER, when I transferred the funds from the Trust Account (as distinct transfers assigned to the relevant client) to the new Checking Account it is essentially a null event.

For example, fiduciaries often miss out everyday household items such as washing machines, computers or even furniture. All together, these schedules tell the story of how the estate/trust has been managed to relevant stakeholders, be it beneficiaries, the court, or other interested parties. Trust reporting requirements involve periodic trust account statements, annual trust account summaries, and trust account audits and reviews. Ongoing training can help staff stay informed about regulatory changes and best practices in trust management. Trust account transactions include deposits, disbursements, and transfers of funds related to the trust. Trust accounting must adhere to applicable laws, regulations, and professional standards to ensure proper administration, transparency, and accountability.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. The system fully integrates with our Fiduciary Calendar, 706, and 1041 programs to streamline data sharing. Access valuation services and automate the setup of starting assets with date of death or starting market values.

Now let’s talk about the costs you pay as a lawyer on behalf of your clients. Hard costs are the costs incurred by your law firm, whereby you directly pay the vendor on your client’s behalf. Soft costs are the costs that you cannot track directly back to your client because you did not directly pay the vendor on behalf of your client. The matter dashboard in Clio gives you an instant overview of the financials, including work in process, outstanding balance, and matter trust funds. In QuickBooks Online alone, it takes three different reports to see these amounts.